Peer-to-Peer Digital Attestations

Decentralized systems, by definition, do not demand central coordinators.Rather, decentralized systems rely on other mechanisms, like market forces or game theoretics, to drive consensus between two or more actors. Decentralized systems are the basis of decentralized applications — user-facing products that are trust-minimized and, generally, do not require a trusted third party, an intermediary, or a coordinating actor.

Decentralized Application #1: Cryptocurrency

Peer-to-peer digital cash (cryptocurrency) is the first decentralized application to emerge out of blockchain technology. Cryptocurrencies allow us to transfer and custody assets directly.

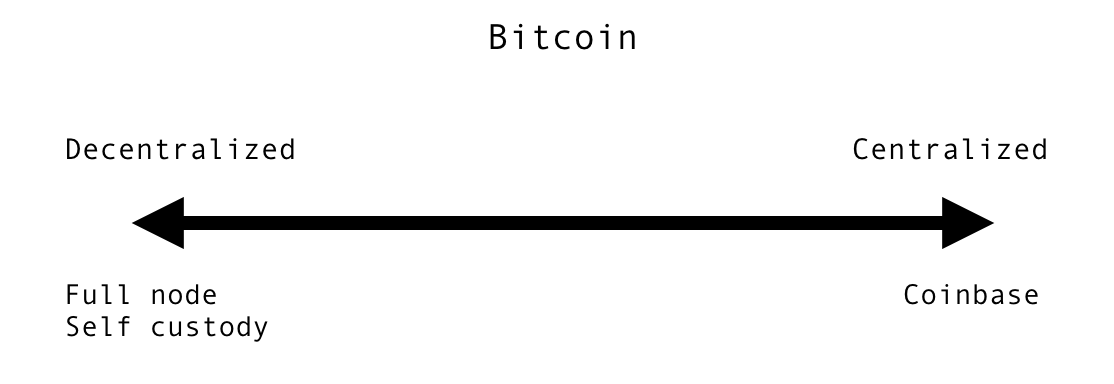

Somewhat ironically, holders of bitcoin by and large continue to rely on centralized infrastructure. For many users’ purposes, the experience of custodians and wallet providers like Coinbase remains superior to self-custody options. These users are happy to make the privacy and trust trade-offs that come with that choice.

There is nothing wrong with users opting to rely on a central party for their use of cryptocurrency. The important innovation here is that they have theoption to self-custody their assets; they have the option of running a full node.

Decentralized Application #2: Exchange

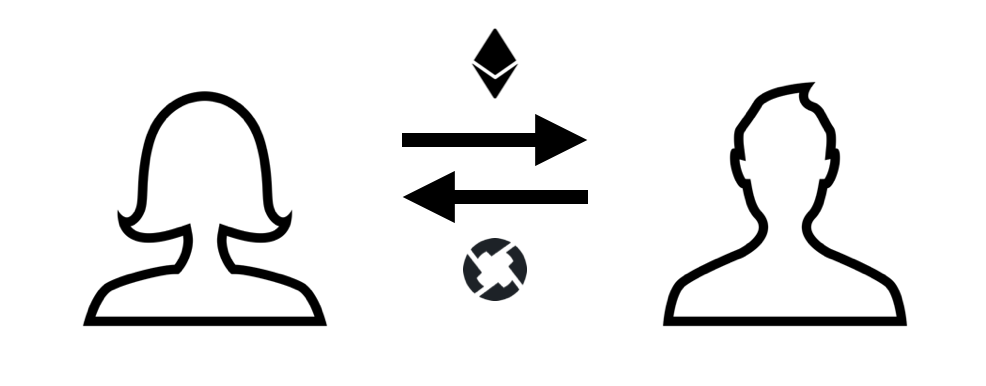

Peer-to-peer decentralized exchange is the second application that is emerging from blockchain-based foundations. Decentralized exchange infrastructure allows us to trade assets without coordinating third parties.

There are no perfectly trustless models for exchange, but the developments in this area are promising and have greatly expanded the spectrum of options available to users.

There are many variations of decentralized exchange protocols and projects that are emerging. Some aim for decentralization at the orderbook layer. Others focus on settlement and custody. If you want to dive into these differences, I would recommend this piece by Mansi Prakash.

In the meantime I will just point out that these various models each serve important functions in that they provide optionality to users. Those looking to exchange their digital assets now have choices depending on whether they value privacy, counterparty risk management, liquidity, regulatory compliance, or UX.

Decentralized Application #3: Lending

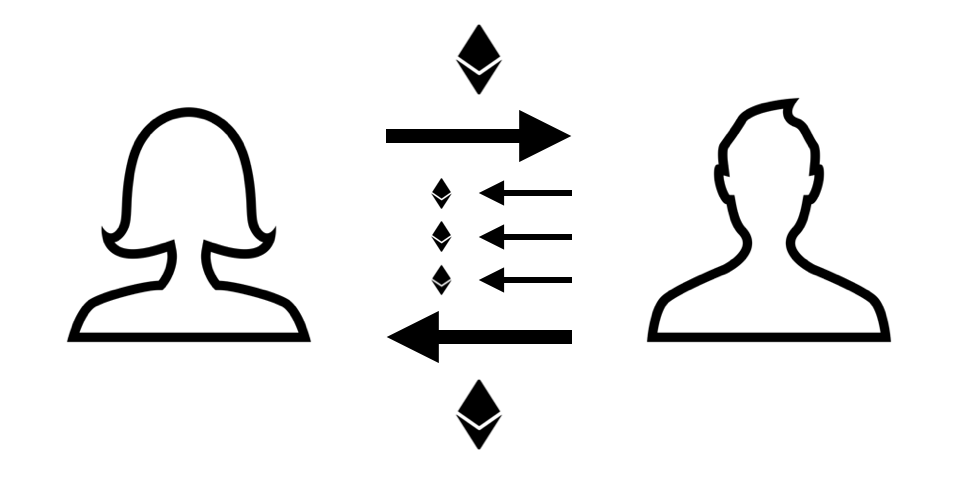

A third decentralized application that is becoming a reality is that of lending. Many of the projects being built around decentralized exchanges enable the creation of loans or the ability to trade on margin.

Peer-to-peer digital lending opens up possibilities for new forms of financial interaction in a decentralized system. Loans give individuals and entities in need of capital access to funds. Blockchain-based borrowing holds the possibility of improving on the legacy model of lending. Programmatic, peer-to-peer margin calls, for example, could mitigate the likelihood of credit crises and over-leveraged systems.

Dharma, dYdX, and Lendroid are just a handful of the compelling projects building these types of systems.

Prospective users of these lending systems, however, don’t yet have options if they are looking to leverage a highly decentralized or trust-minimized system. This is due to one missing component…

Decentralized Credit Scoring

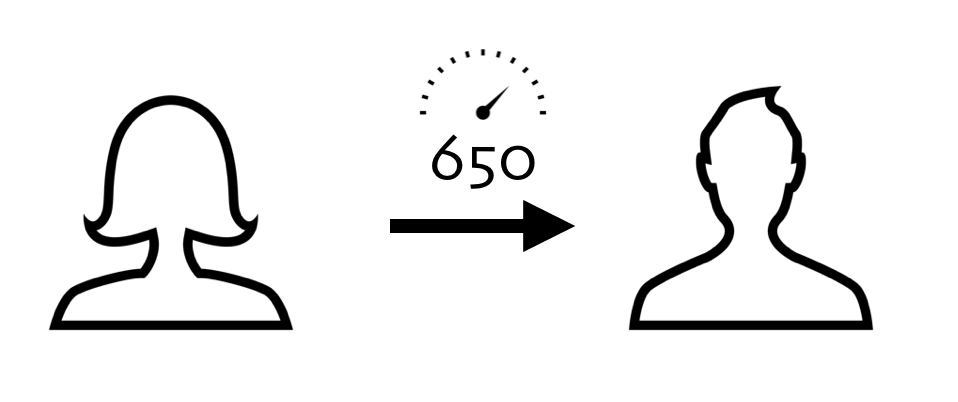

Every loan has a borrower and a lender. The lender examines the credit of the borrower to determine how to price the loan (how much interest to charge). The borrower’s credit is based on his historical behavior and current financial status.

Today, credit scoring is generally a centralized process that relies on attestations from a single authority or an oligopoly. An example of a single authority might be a bank or credit card company providing information about an account’s history. Oligopolies that provide credit scoring services include Transunion / Experian / Equifax for US individuals and Fitch / Moody’s / S&P for corporations. Both models rely on sets of central authorities.

But there do exist possibilities for more peer-to-peer models of credit scoring.

Rather than rely on attestations by a single authority or an oligopoly, lenders can use a web of trust model. Parties known to or trusted by the lender can make attestations about the attributes or historical behavior of the borrower. These can be made by institutions, like wallets or exchanges, or individuals.

Borrowers seeking to prioritize trust-minimization at all costs can take an even more decentralized approach and provide lenders only with their on-chain funds and transaction history as a proxy for credit score. This is obviously a weak indicator of creditworthiness and is a set up prone to exit scams — meaning this loan would demand a much higher interest rate — but for some users, this trade-off in favor of privacy may be worth it.

Further combinations and variants of these solutions can also be imagined. The Dharma team, for example, has suggested that zero knowledge proofscould help protect the privacy of borrowers as pertains to their credit history.

Implementations of decentralized anonymous credentials could also unlock possibilities for enhanced privacy and trust-minimization in a credit scoring system.

In order to enable a fuller spectrum of decentralized lending, some of these options for credit scoring need to be explored.

Identity

Credit scoring is really just an aspect of identity. It is one form of reputation.

Solutions for decentralized credit scoring, therefore, could be extrapolated into larger identity systems that do not rely on a single central authority. Attestations could go beyond historical transactions and extend to KYC/AML, accredited investor status, or even governments attesting citizenship, residency, and visas.

The problems posed by centralized digital identity solutions have been more deeply felt than ever in the last year. From the Equifax hack to China’s development of a social credit score, solutions created by central third parties have come to be viewed as insecure at best and dystopian at worst.

The development of new digital systems of interaction and transaction based on blockchain protocols have, in their own way, demonstrated the need for a decentralized alternative to the old identity systems. As the markets developed upon blockchain-based infrastructure continue to mature, demand is emerging for more complex forms of peer-to-peer trade, exchange, and interaction, many of which will need notions of credit and identity.

Further Reading

Security Without Identification: Transaction Systems to Make Big Brother Obsolete, Chaum

Decentralized Anonymous Credentials, Garman, Green, Miers

ERC: Identity #725, Vogelsteller et al.

0x Whitepaper, Warren, Bandeali

dYdX Whitepaper, Juliano

Dharma Whitepaper, Hollander

Lendroid Whitepaper, Sundaresan, Meenakshisundaram, Venkateswaran

Thanks are due to David Danko for his work with me in developing these thoughts.

Ideas here drawn from a lot of conversations and work done with Will Warren, Antonio Juliano, Andy Bromberg, Zooko Wilcox and others. All errata and logical fallacies are, as always, my own.