Transforming Ownership Through Infrastructure

I have written in the past that blockchain technology is all about assets.

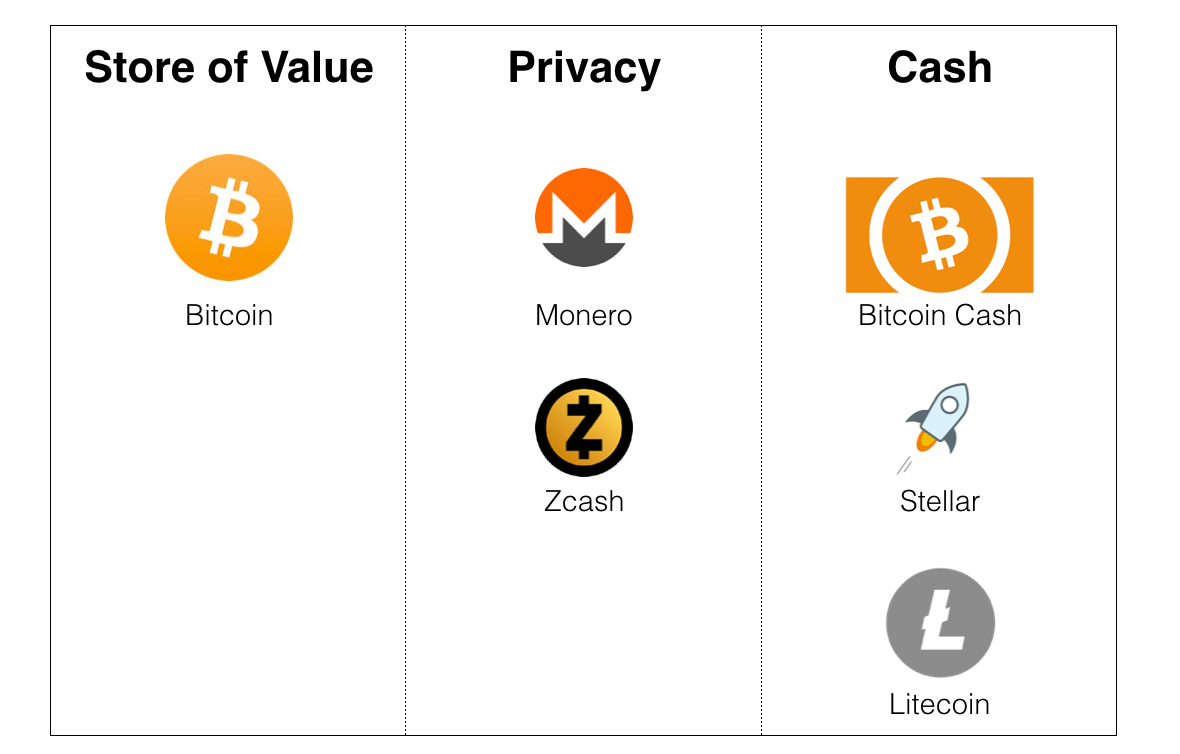

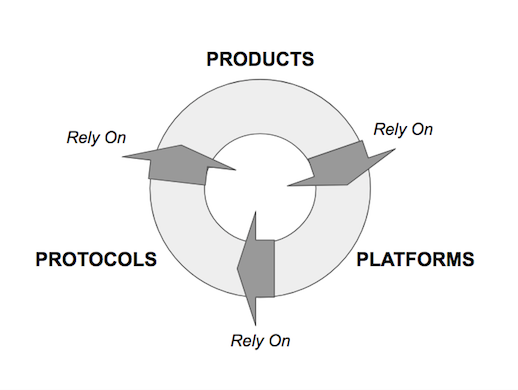

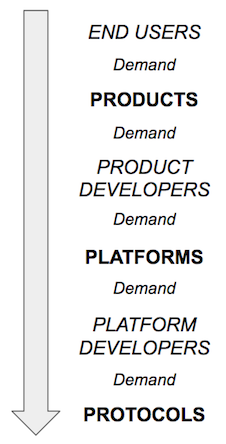

More specifically, though, it’s about how we interact with assets. It’s about new ways of custodying property. It’s about transacting digitally, without the involvement of coordinating third parties. Sometimes it’s about being able to do so privately. Achieving any of this is a larger issue than what the assets themselves are capable of. It also has a lot to do with the infrastructure we use.

For example: gold bars. By their very nature, I am able to directly own gold bars. I can store them in my garage, if I want to. But, in order to feel good about this, I need to be able to buy a personal safe, learn how to operate it, and have it installed in my house. If this is not an option, I might just choose to keep them in a safety deposit box at the bank. Just because I can hold onto physical gold myself, does not mean I do. The infrastructure I have access to matters here.

Similarly: bitcoin. I can custody bitcoin myself, directly, by holding my own private keys on a piece of hardware or even a piece of paper. Many owners of bitcoin choose to do this. Many others choose to entrust their private keys to an exchange or another third party. Again, the infrastructure matters.

I have said before that, in order for a new asset to be defensible against its legacy counterparts, it must enable a new form of ownership, value transfer, or coordination. My ability to reasonably custody and transfer assets in these new ways is as much dependent on the available infrastructure as it is on the assets themselves.

This is not a new lesson. In fact, we have already once seen a prolonged period of blockchain hype around financial infrastructure (as opposed to assets).

The difficulty in devising and designing new asset classes was a key lesson that emerged out of the altcoin craze in 2013 and 2014. Altcoins were all about the creation of new assets, but the infrastructure getting built around these assets was largely centralized. Mt. Gox was the exchange of choice (for a brief time anyway). Coinbase emerged as the major retail platform for buying, selling, and holding. LocalBitcoins served as a real life on-ramp. The assets were new, and the companies and brands were largely new, but the infrastructure looked old.

The market spent the following two years focused on building decentralized experiences around legacy assets. The concept of the permissioned blockchain was born. Say what you will about permissioned blockchains, this shift in focus was a logical move by a market that realized creating value with no legal structures or strong cultural forces around it was no easy task.

Keep the old, legacy assets, but build decentralized infrastructure. What if we could custody equities without relying on rent-seeking intermediaries? What if we could track diamonds as they moved through the world without needing a single, central database? And (*whispers*) what if we could tradesyndicated loans in such a way that they did not take weeks to move through the antiquated plumbing of the financial system?

Out of the altcoin wreckage, 2015 saw an awakening to the fact that infrastructure is a critical component of the promise of blockchain technology. While it looks very different this time around, a similar realization is emerging from the token mania of the last year. 2018 is witnessing the pendulum again swing back to innovation in infrastructure.

There is perhaps no better example of rearchitecting infrastructure around assets than the innovation currently happening with decentralized exchange.In the first few weeks of the year, 0x has already achieved more than $10 million worth of transactions in a single day.

Self-custody also looks poised to make huge strides. Private key management by individuals and institutions alike has long been a critical UX issue. Ledger’s fundraising round should position it to bring hardware wallets even more mainstream. Radar Relay’s integration with Ledger takes the market a long way in terms of balancing usability, access to liquidity, and secure self-custody. MobileCoin’s use of SGX and remote attestation, while perhaps not the ideal cypherpunk solution to key management, also marks an important experiment in private key custody.

The important progress being made on payment channels also belongs in this category of infrastructure. With the mainnet finish line in sight, 2018 looks to be the year Lightning goes fully live.

Blockchain technology has never just been about the issuance of new assets. It’s about how we can custody, trade, transact, and secure value in new ways. This year, look to infrastructure projects to deliver the real transformation.