Make Something People Want

The question of the killer app of blockchain technology is a popular topic.

Some of the answers have already presented themselves — and they have come in the form of assets, not applications.

I have written in the past about the history of blockchain innovation. I outlined three waves of experimentation since the creation of bitcoin:altcoins, permissioned blockchains, and tokens. Several insights can be drawn from these waves. These phases of innovation and exploration have a common theme: the search for killer blockchain apps has all along been a search for assets. Product-market fit in blockchain technology has always been about the digital (or digitizable) assets.

The search for assets began with fundamentally new assets in the form of altcoins. Permissioned blockchain technology attempted to apply the new technology to pre-existing asset classes. The tokens that have been center-stage for the last 9 months have represented a shift back to exploration of new forms of value.

Inventing new assets is no easy feat. Wall Street has been attempting it for decades — with varying levels of success and disaster (and sometimes both).

Financial engineering can mean many things, but amongst those definitions is the practice of inventing new financial instruments. These structures and vehicles allow people — usually professional investors and traders — to allocate capital and manage exposure in new ways. Credit default swaps, collateralized debt obligations, and convertibles are examples of these. Sometimes these instruments allow consumers to invest or borrow in new ways. ETFs and mortgage-backed securities fall into this category.

For a new asset to be defensible against its legacy counterparts, it must enable a new form of ownership, value transfer, or coordination. CDOs and ETFs were enabled by repackaging existing instruments and agreements. Cryptocurrencies and tokens are different. They invent entirely new assets through innovations in technology, as well as law and market structure.

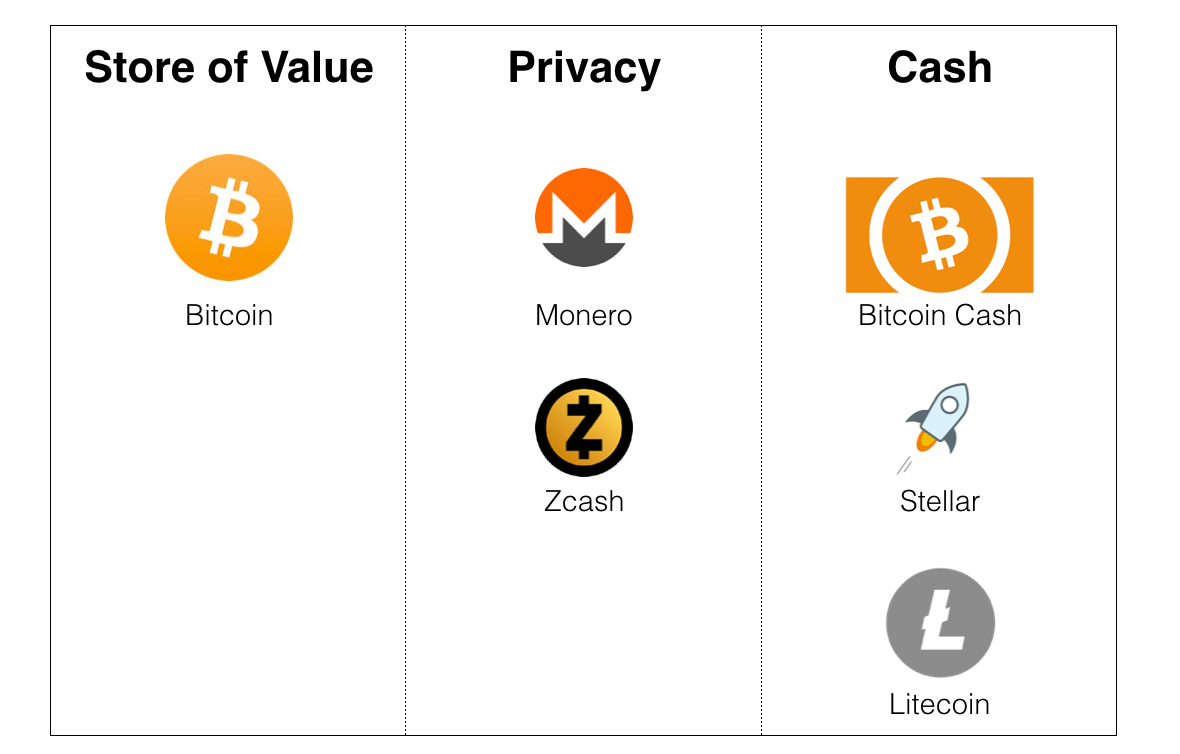

There are three types of assets built on blockchain technology that, today, can count themselves as defensible against their legacy counterparts.

- Store of Value coins enable direct yet digital ownership in a way that neither physical gold nor digital bank accounts can.

- Privacy coins achieve the above, while also adding features of increased anonymity and obfuscation.

- Cash coins that optimize for throughput, latency, low/predictable fees, and transaction finality achieve disintermediated yet digital transactions — an accomplishment that neither physical cash nor PayPal can promise.

The question of the killer apps of blockchain technology always comes back to the assets involved. The startup adage that says to make something people want applies as much to cryptocurrencies and tokens as it does to any other new product or innovation. So far, it seems like by and large what people want is to be able to speculate and gamble.

But as I’ve said before, speculation is not itself a use case. So look past the price pumps and instead, seek out assets that enable something that was previously impossible.